The 3.8% Obamacare Surtax and how to avoid it. This Medicare surtax can be avoided or minimized with a little proactive tax planning. Don’t be surprised if your LA financial advisor or Palm Springs financial planner needs to take a proactive approach to help you minimize your tax bills. Proactive tax planning is imperative for those with large incomes. Tax planning is even more valuable for those making significant incomes in California, a high-tax state.

A surprise Birthday Party may be fun, and a surprise tax bill is not. Many people in Los Angeles are getting hit with the Obamacare surtax, and with a bit of tax planning, man could avoid getting surprised with a pesky tax bill.

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

I’m a Financial Planner in LA where people tend to skew more liberal politically compared to other parts of the county. If you were to randomly pick people on the street and ask them if they support Medicare for all or healthcare for everyone, you would probably get more responses of yes than no. However, support of universal healthcare in SoCal creates a bit of a conundrum for our pocketbooks. California already has some of the highest state-level income taxes in the country, topping out at 13.3%. This is on top of a top 37% Federal Tax Bracket. Taxpayers in the top income brackets are likely to also be subject to an additional 3.8% Medicare Surtax on much of their income.

Why? Income levels tend to be higher in California, also known as the Golden State. The higher the income, the more money those in support of healthcare for everyone will have to pay in taxes. The 3.8% medicare surtax on higher incomes seems to be the tax that surprises and annoys many people who find themselves getting hit with it for the first time. The only good news about paying this surtax is that it means you are making more money than 90% plus of Americans. Of course, I don’t think that will make that big tax bill sting any less.

Where Did The Obamacare Medicare Surtax Come From?

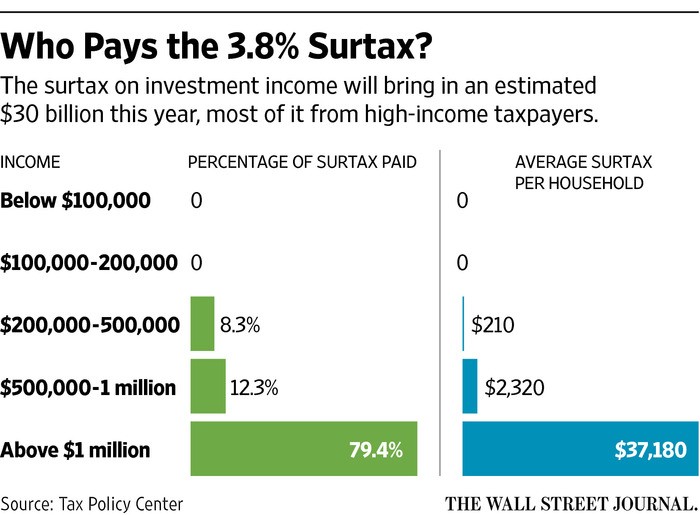

To help fund the Affordable Care Act (also dubbed Obamacare), there was a 3.8% surtax levied against higher incomes. This specific tax took effect in 2013 and, according to the Tax Policy Center, is expected to bring in nearly 30 billion dollars of tax revenue.

This surtax begins for those making just $200,000. Arguably a great income, but those making it don’t exactly scream rich here in La La Land. The surtax was supposed to be a tax on the RICHEST Americans and, for the most part, it is. It is worth pointing out that there is a difference between income and wealth. Around three-fourths of the surtax, revenue comes from households earning more than $1 million per year. According to the Wall Street Journal, these households will owe an average of $37,000 each. While households earning between $200,000 and $500,000 will owe an average of $200 each. As your income grows, likely so will the amount you owe for the Medicare Surtax.

The surcharge may not hit you now but beware. Statistics can often lie. The averages above conceal wide variations in real people’s tax bills. The Obamacare surtax trigger points are not adjusted for inflation. Things like big investment windfalls, home sales, or stock option exercises, could increase your income subject to this tax. The medicare surtax considers all forms of income, not just your salary from working.

There are likely many people earning just above $200,000 whose surtax bill will be minimal, artificially bringing down the “average” bill for those between $200,000 and $500,000. To be clearer if you earned $500,000, you would owe $11,400 from just this surtax. I should point out, what many of you already know, that $200,000 doesn’t go that far when trying to buy a house in Los Angeles.

How the Obamacare Medicare Tax Works

There is a flat surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000. Another example of the marriage penalty at work in our tax code.

The levy is only for investment income above the thresholds. For example, if you make $100,000, you won’t owe any additional taxes.

However, let’s say you are a single earner making $180,000 of AGI each year and experienced a one-time gain of $100,000 from selling long-held stock shares (this could also be a home sale or employer stock options.) This would increase your income to $280,000, making $80,000 of your total income subject to the 3.8% surtax. This would result in you owing roughly $3,040 in extra taxes just from the Medicare Surtax.

When I listed the above income ranges, I bet you just thought about your own paycheck. Only considering their paychecks is why so many people are surprised when they get hit with this tax for the first time.

What Will Be Counted As Investment Income?

Things like interest, dividends, capital gains, rental income, royalties, and even some passive investment income will be counted as investment income.

What Is Not Counted As Investment Income?

Generally speaking, you can exclude income from municipal bonds, partnership income, and S Corporations if you are actively participating. There are also certain types of rental income and some capital gains, for selling a business, that may be excluded as well.

How To Minimize The Medicare Surtax Sting

You may not be able to completely avoid the ACA surtax, but with a little smart tax planning, you should be able to minimize it. Here are a few smart tax planning tips.

- Before you sell a highly appreciated home, consider your income and this tax. Many couples will have nothing to worry about as you can potentially exclude up to $500,000 ($250,000 for singles) profit on the sale of a primary residence. While $500,000 is a nice exemption, that doesn’t go as far around Los Angeles or Palm Springs as it does in Arkansas.

- Don’t ignore tax harvesting. I’ve been doing this since 2004 for clients and it still amazes me how few so-called financial advisors take the time to do this. It is extra work, but it can make a huge difference on net investor returns. The 3.8% Obamacare surtax is also levied on net investment income. If you are winning big on one holding, you may have losses you can realize on other holdings to help minimize your tax bill. If I’m making your eyes cross, don’t worry. A good fiduciary financial planner can help take care of it for you.

- Look for ways to minimize your AGI. The lower your AGI (the number at the bottom of the TAX-FORM 1040) the lower the amount of your income will be subject to the 3.8% surtax.

- Need another reason to contribute to your retirement plan? Making contributions to your 401k, 403b or pension will lower your AGI. You can also make charitable contributions from your IRA assets if you are over 70 ½. Here are some strategies to make the most of your RMDs.

How To Deal With Retirement Income

Income from retirement accounts like IRA’s, pensions and 401ks are not directly subject to the 3.8% surtax. That being said, they may lift other forms of income into the medicare surtax realm. Let me give you an example. Let’s say a couple did a great job saving for retirement and have $300,000 in retirement income from IRA’s, social security and a Defined Benefit Pension plan. In this case, they wouldn’t owe the surtax since all of this income came from retirement accounts. Now, let’s say they also have $20,000 in capital gains on their stock portfolio. They would owe the 3.8% Obamacare surtax on the full $20,000 since this amount would be on top of their retirement income. Having a more tax-efficient portfolio could help alleviate some of this extra MEDICARE surtax burden.

ROTH IRA To The Rescue

Payment from a ROTH IRA or ROTH 401(k) comes out tax-free and doesn’t raise taxable income. This can also help minimize the burden of the 3.8% surtax. This is where diversification of your retirement account taxation can really pay off. If you will have certain years with high investment income, you will want to adjust your withdrawal strategy to minimize overall taxes and the 3.8% surtax. Look for ways to increase your tax-free income as your march towards financial freedom.

You Can Escape the Healthcare Surtax By Dying

Your heir or heirs receive a step-up in basis when you pass away. So, if you hold investments up until the time of your passing, there won’t be capital gains taxes or the ACA surtax on the earnings prior to your passing. Of course, you have to die, so not always a great option. This only applies to taxable accounts. Your heirs will owe taxes on withdrawals from Inherited IRAs.

Now that we’ve covered death and taxes, it is time to wrap this up.

Have you been hit with the Medicare Surtax? Feel free to reach out and see how we can help you keep more of your hard-earned money. Tax planning should be part of your comprehensive financial plan. If your so-called financial advisor does not help you minimize your taxes, then it is likely time to upgrade to a fiduciary financial planner who offers proactive tax planning.

Live for Today, Plan for Tomorrow.

DAVID RAE, CFP®, AIF® is a Los Angeles-based retirement planner with DRM Wealth Management. He has been helping friends of the LGBT community reach their financial goals for over a decade. He is a regular contributor to Advocate Magazine, Forbes.com, Huffington Post as well as the author of the Financial Planner Los Angeles Blog. Follow him on Facebook, or via his website www.davidraefp.com

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual.

[…] 35% of the estimated costs in retirement while the remainder is the cost-sharing in and out of Medicare that you will have for co-payments and deductibles. That includes out-of-pocket expenses for […]

[…] Related: The Best Ways to Avoid the 3.8% Obamacare Tax […]

[…] Related: The 3.8% Obamacare Surtax – and How to Avoid It […]

[…] Related: The 3.8% Obamacare Surtax – and How to Avoid It […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] and every year we see some small changes to Social Security and Medicare. This year is no different. How much you will receive from Social Security during retirement, to […]

[…] premium increases for Medicare Part B have not yet been announced, but they will likely eat up most of the Social Security COLA for 2021. […]

[…] conclusion at the aforementioned capital gains taxes. I would be remiss if I did not point out the 3.8% surtax on “net financial investment money” for joint filers with modified modified gross revenue of a lot more than $250,000 and most […]

[…] does not end at the aforementioned capital gains taxes. I would be remiss if I didn’t mention the 3.8% surtax on “net investment income” for joint filers with modified adjusted gross income of more than $250,000 and most singles […]

[…] does not end at the aforementioned capital gains taxes. I would be remiss if I didn’t mention the 3.8% surtax on “net investment income” for joint filers with modified adjusted gross income of more than $250,000 and most singles […]

[…] does not end at the aforementioned capital gains taxes. I would be remiss if I didn’t mention the 3.8% surtax on “net investment income” for joint filers with modified adjusted gross income of more than $250,000 and most singles […]

[…] does not end at the aforementioned capital gains taxes. I would be remiss if I didn’t mention the 3.8% surtax on “net investment income” for joint filers with modified adjusted gross income of more than $250,000 and most singles […]

[…] not end at the aforementioned capital gains taxes. I would be remiss if I didn’t mention the 3.8% surtax on “net investment income” for joint filers with modified adjusted gross income of more than $250,000 and most singles […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] savers dread these withdrawals because they are taxable distributions that can drive up their tax bills. Hopefully, these RMD Tips can help you maximize your Retirement […]

[…] Additional Medicare Taxes for Higher Earners […]

[…] income fell into their current top tax bracket at both the state and federal levels. They also saw a large Obamacare 3.8% surtax on investment income when filing as single. Now, Jim will have a smaller standard deduction as a widower than when George […]

[…] income fell into their current top tax bracket at both the state and federal levels. They also saw a large Obamacare 3.8% surtax on investment income when filing as single. Now, Jim will have a smaller standard deduction as a widower than when George […]

[…] earners may also get hit with the Obamacare surtax. This is a 3.8% surtax on net investment income (NII) on top of the capital gains rate for single […]

[…] tax brackets, pushing their total taxes on the last dollars earner beyond 53% when including the Obamacare surtax. They are also providing a wonderful benefit for their loyal employees while staying on track for […]

[…] help you qualify for stimulus payments, child tax credits, or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] help you qualify for stimulus payments, child tax credits, or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] Alternatives for proactive tax planning are even bigger for many who are self-employed or small enterprise house owners. This could additionally embody these with a aspect hustle or different self-employment revenue. Establishing the fitting company constructions can immediately have an effect on your total charges every year. Likewise, organising the fitting retirement plan can dramatically improve your tax financial savings, in addition to assist reduce issues just like the 3.8% Obamacare surtax. […]

[…] Alternatives for proactive tax planning are even bigger for individuals who are self-employed or small enterprise house owners. This may additionally embody these with a aspect hustle or different self-employment revenue. Organising the appropriate company constructions can instantly have an effect on your general charges every year. Likewise, organising the appropriate retirement plan can dramatically enhance your tax financial savings, in addition to assist reduce issues just like the 3.8% Obamacare surtax. […]

1. is 3.8% paid only for long capital gain (from stocks) or also from short capital gain

2. if I reduce my taxable rent to zero income using depritiation for example (or expenses), in that case that earning does not count for 3.8% tax right ? – its just net

[…] Opportunities for proactive tax planning are even larger for those who are self-employed or small business owners. This can also include those with a side hustle or other self-employment income. Setting up the right corporate structures can directly affect your overall rates each year. Likewise, setting up the right retirement plan can dramatically increase your tax savings, as well as help minimize things like the 3.8% Obamacare surtax. […]

[…] A lower AGI can keep your income in lower tax brackets; it can potentially help you benefit from more tax credits or avoid additional taxes like the Medicare surtax. […]

[…] it can potentially help you benefit from more tax credits or avoid additional taxes like the Medicare surtax. Some ways you can lower your AGI might fall on your personal tax returns. This includes things […]

[…] disappears. You’re left paying 2.9% to Medicare for a bit of your extra income. In the end, a 3.9% Sertex Medicare on high incomes. The Medicare surcharge starts at $200,000 for single subscribers and $250,000 for […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] away. You’re left paying 2.9% to Medicare for a bit in your further earnings. Ultimately, a 3.9% Medicare Surtax kicks in on greater incomes. The Medicare surtax kicks in at $200,000 for single filers and […]

[…] away. You’re left paying 2.9% to Medicare for a bit in your extra earnings. Ultimately, a 3.9% Medicare Surtax kicks in on increased incomes. The Medicare surtax kicks in at $200,000 for single filers and […]

[…] away. You might be left paying 2.9% to Medicare for a bit in your further earnings. Ultimately, a 3.9% Medicare Surtax kicks in on greater incomes. The Medicare surtax kicks in at $200,000 for single filers and […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] goes away. You are left paying 2.9% to Medicare for a bit on your additional income. Eventually, a 3.9% Medicare Surtax kicks in on higher incomes. The Medicare surtax kicks in at $200,000 for single filers and $250,000 […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] But some valuable perks make this extra step worth it. First, it can help you avoid or minimize the additional high income tax in Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, you […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] benefits make this additional step value it. First, it could aid you keep away from or reduce the high-income surtax on Medicare Half B and D. Likewise, with the overwhelming majority of Individuals taking the usual deduction, […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] valuable advantages make this extra step worth it. First, it can help you avoid or minimize the high-income surtax on Medicare Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] some valuable benefits that make this extra step worth it. First, it can help you avoid or minimize surtax on health insurance for high earners Part B and D. Likewise, with the vast majority of Americans taking the standard deduction, they […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] be sure you have a plan to obtain medical care. Will docs settle for your U.S. medical insurance or Medicare? Will you get high quality therapy in your present and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] be sure you have a plan to obtain medical care. Will docs settle for your U.S. medical insurance or Medicare? Will you get high quality remedy on your present and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] ensure you have a plan to obtain medical care. Will docs settle for your U.S. medical insurance or Medicare? Will you get high quality therapy to your present and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] abroad, make sure you have a health care plan. Will the doctors accept your US health insurance or state health insurance? Will you receive quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] sure you have a plan to receive medical care. Will doctors accept your U.S. health insurance or Medicare? Will you get quality treatment for your current and future medical […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] for stimulus funds and youngster tax credit or drop your earnings sufficient to keep away from the Obamacare Surtax on funding earnings. Plus, saving for retirement will assist you will have a greater retirement sooner or […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or reduce your income enough to avoid the Obamacare surtax on investment income. Also, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] for stimulus funds and baby tax credit or drop your revenue sufficient to keep away from the Obamacare Surtax on investment income. Plus, saving for retirement will assist you’ve a greater retirement sooner or […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] you qualify for stimulus payments and child tax credits or drop your income enough to avoid the Obamacare Surtax on investment income. Plus, saving for retirement will help you have a better retirement in the […]

[…] help you qualify for stimulus payments and child tax credits or drop your income enough to avoid Obamacare Surtax on investment income. In addition, saving for retirement will help you have a better retirement in the […]

[…] Obama administration said that unscrupulous or conflicted advice costs American savers $17 billion a year. This lowers […]

David: I read your interesting article re the Obamacare 3.8% tax. I am.retired and 74 years old. while working for L A City I put some money in a deferred comp plan which I now am withdrawing. Is this subject to the 3.8 % tax if income exceeds $250k ? )married filing jointly). Thanks, Scott

[…] A lower AGI can keep your income in lower tax brackets; it can potentially help you benefit from more tax credits or avoid additional taxes like the Medicare surtax. […]

[…] from the employee’s income. They are not subject to federal income tax, Social Security or Medicare taxes. If you were wondering, employer contributions are deductible as a business expense to the […]

[…] dream is that you will eventually turn 65, and all your healthcare expenses will be covered by Medicare. I hate to be the bearer of bad news, but in the real world, healthcare costs in retirement years […]

[…] dream is that you’ll ultimately flip 65, and all of your healthcare bills might be coated by Medicare. I hate to be the bearer of dangerous information, however in the actual world, healthcare prices […]

[…] dream is that you’ll finally flip 65, and all of your healthcare bills might be coated by Medicare. I hate to be the bearer of unhealthy information, however in the actual world, healthcare prices […]

[…] retirees may be surprised to find themselves getting hit with Medicare surcharges based on their income levels. The income-related monthly adjustment amount (IRMAA) is a surcharge […]

[…] retirees may be surprised to find themselves getting hit with Medicare surcharges based on their income levels. The income-related monthly adjustment amount (IRMAA) is a surcharge […]

[…] retirees may be surprised to find themselves getting hit with Medicare surcharges based on their income levels. The income-related monthly adjustment amount (IRMAA) is a surcharge […]

[…] retirees may be surprised to find themselves getting hit with Medicare surcharges based on their income levels. The income-related monthly adjustment amount (IRMAA) is a surcharge […]

[…] retirees may be surprised to find themselves getting hit with Medicare surcharges based on their income levels. The income-related monthly adjustment amount (IRMAA) is a surcharge […]

[…] retirees may be surprised to find themselves getting hit with Medicare surcharges based on their income levels. The income-related monthly adjustment amount (IRMAA) is a surcharge […]

[…] Regarding Medicare benefits, a second Trump presidency could result in increased privatization to ensure benefits are available. However, we never saw much effort put into Trumpcare other than the efforts to repeal Obamacare. […]

[…] felt they could afford to donate to charity. The extra $100,000 of realized income increased their Medicare premiums and pushed other income into higher tax brackets at both the state and federal levels. While you […]

[…] felt they could afford to donate to charity. The extra $100,000 of realized income increased their Medicare premiums and pushed other income into higher tax brackets at both the state and federal levels. While you […]

This guy is a proud libtard who is a financial planner? No thank you! I’ll take someone with some critical thinking skills.

[…] Even if you are determined to sell your Tesla stock, be aware of the tax consequences. You could get hit with 15-20% federal capital gains taxes with more taxes at the state level. Additionally, if your income is above $200,000 (single) and $250,000 (married), you could get hit with Net Invest Income Tax (NIIT), which adds another 3.8% to your tax bill. […]